Cognitive and biological science has demonstrated that our animal instincts replace human reasoning in the face of mortal threats. When individual survival is at stake, Charles Darwin trumps Adam Smith.

Instincts are powerful. They are put into practice without training or thought. But they aren’t always “right.” Those of us who’ve lived a little know that some threats are real while others are illusions of our imperfect ability to perceive the world around us. A noise in the dark will awaken a deep sleeper, even if it’s from the wind knocking over a trashcan rather than a lion preparing to pounce.

I started with a biology lesson because I believe that collectively, our imperfect instincts have distracted us from reality when it comes to the current economic crisis. Let me explain why.

The past twenty years of improving American prosperity have conditioned us that there is a single economic reality: consistent and predictable quarter-over-quarter growth. In the past year this perception has been challenged by sharp declines in prices for stocks, homes and labor. We’ve weathered other declines in financial markets, specifically in 1987 and 2001. The difference is that the current decline is broader-based and steeper than those other declines. No question about it, these changes are frightening.

With regard to the economy, I believe its time to turn decision-making back to human reasoning. The sense of mortal threat needs to be eliminated before reason can take over. Have you noticed:

- The sun has come up every day

- Your family still loves you

- Police patrol our streets and teachers teach our children

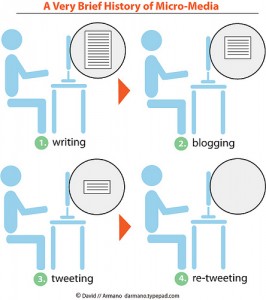

- Innovators are still looking for the next big idea

- Entrepreneurs are still looking for the next opportunity

- Lions didn’t pounce in my neighborhood last night

Volatility: It’s Not that Bad

The main lesson I’m learning from the crisis is that volatility is greater today then my comfort level allows. Yes, housing prices have fallen and markets are disorderly. Some individuals are facing “gambler’s ruin” which will severely impact their lives.

On the positive side, social services are available to soften the economic blow for many (though not all). I’m making the choice to accept the higher levels of volatility. Asset values will rise sometime in the future as certainly as the sun will rise tomorrow. Price volatility will remain high for some time and I need to deal with that.

Volatility is the new equilibrium. Purple is the new black. Democrat is the new Republican. Green energy is the new biotech. I’m ready to tackle volatility with my intellect and humanity.

Are you?